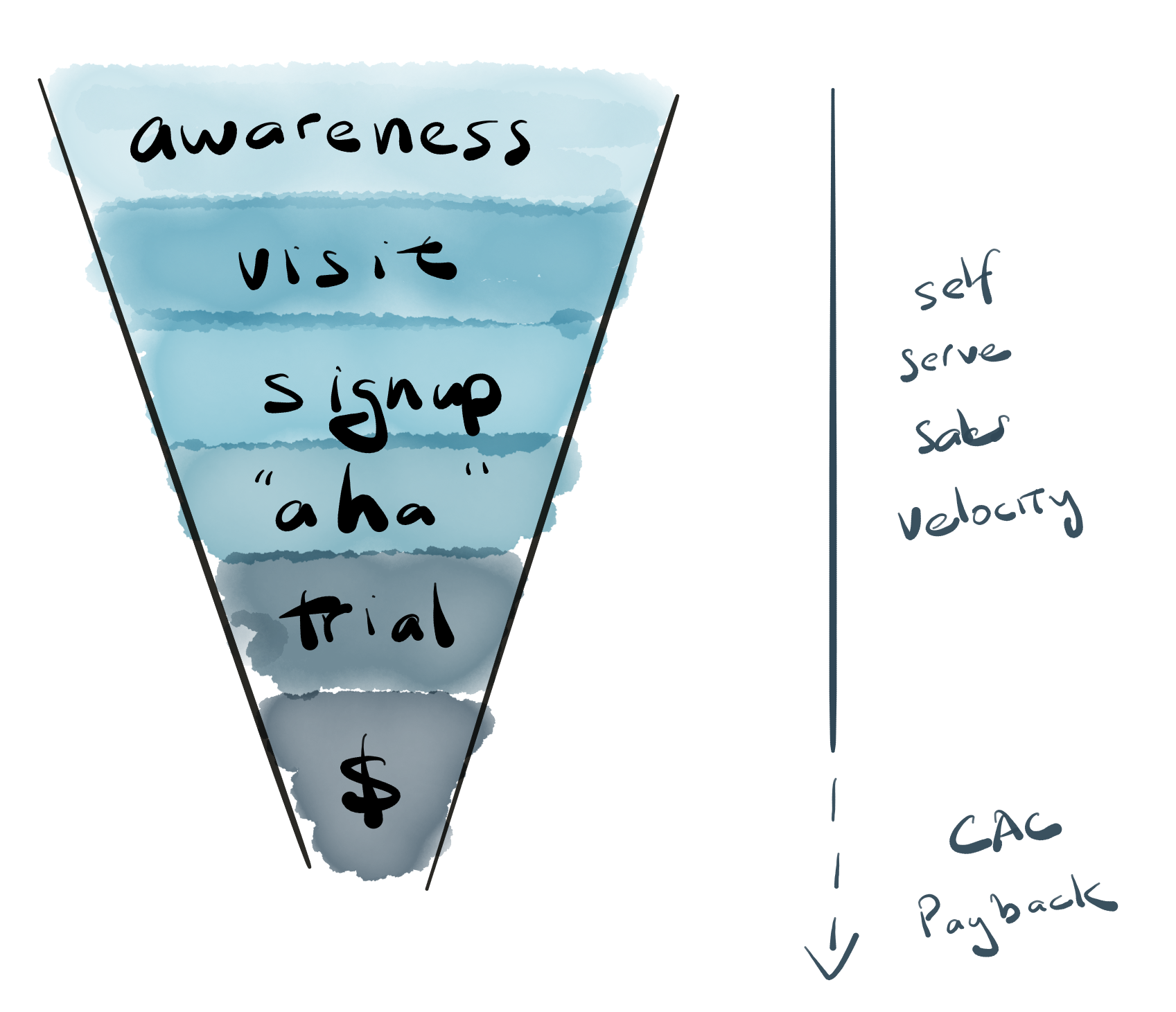

SaaS Economics: Funnels

When I was new to technology, I believed great products spread via word-of-mouth and revenue just happened. The truth is, even a viral product like Facebook buys Adwords, and sometimes worse products can beat better products if they’re able to smartly and aggressively invest capital. Measuring and tuning their funnel is the first discipline.

Turning Investment into Revenue

The stages of a funnel can vary between businesses, but to give you some idea, Sentry’s stages look something like this (conversion rates are obviously made up):

| Stage | Conversion |

|---|---|

| Visit site to signup | 10% |

| Send an event | 60% |

| Start trial | 20% |

| Subscribe to a paid plan | 50% |

| Net conversion rate | 0.6% |

A few other assumptions:

- 10% market return

- 1% monthly churn (90% yearly)

- $600 ACV (ergo LTV of $3,000)

Based on this, some napkin math will tell us how much we can pay per click:

$3000 (LTV)

x 30% (paid)

x 20% (trial)

x 60% (activation)

x 5% (signup)

= $5.40 CPCTo sum it up, if I pay on average $5.40 per click for advertising, and the customers are entirely self-serve, my business returns 10% on invested capital. Here, I’m allowing CAC (or customer acquisition cost) to be equal to LTV and only looking at self-serve customers1.

Tuning this funnel is a large part of growth engineering. For instance, introducing basic on-boarding into Sentry increased our trial conversion rate by 40%. Multipliation is commutative, so increasing any stage of the funnel increases our maximum CPC by the same amount, letting your marketing team out-bid your competitors. Every marketing funnel is, of course, quite different. Someone who’s organically interested in Sentry is much more likely to convert than someone clicking on an ad. The work of growth engineering is segregating, measuring, tuning, and re-investing into funnels that produce the highest returns.

While I used LTV for my calculations, few companies actually use that. Otherwise, you’d spend $3 million acquiring 1,000 customers. Taht would mean that next year, you’d be limited to the $600,000 in revenue to re-invest to acquire 200 new customers. At the same time, you’ll have lost 100 customers to churn, reducing your businesses growth even more. At this point, we come to our next lesson: cash flow.

Footnotes

-

If you add a sales organization into the mix, CAC increases significantly. A salesperson’s total cost (including their salary + commission and “supporting” costs of tooling, managers, analysts, sales engineers, business enablement engineers, account management) can be well north of $1,200 per day. This means they need to close at least three deals a day for the organization to break even or, more likely, they close one deal a week with a much higher ACV. ↩