SaaS Economics: Cash Flow

This post is a continuation of SaaS Economics: Funnels. Please read it before reading this.

So, we’ve touched on SaaS funnel economics, the first lever into SaaS revenue growth. The second is cash flow and here, it’s all about reducing the CAC payback period.

The CAC payback period is the time it takes to recoup the money you spent in acquiring the customer. Previously, we used LTV as a “good enough” proxy, but at the end, we realized that if we rely on LTV, we’ll end up growing very slowly or in an endless loop of fundraising.

If you recall, we’re looking at businesses as a function that accepts two inputs (time and money) and returns more money. CAC payback focuses on the time aspect of the investment. A business that turns $1 to $2 over a month is just as good as a that turns $1 to $2,048 over a year. Therefore, we come to second mechanism (after funnels) for improving returns on investment.

Reducing CAC Payback Time

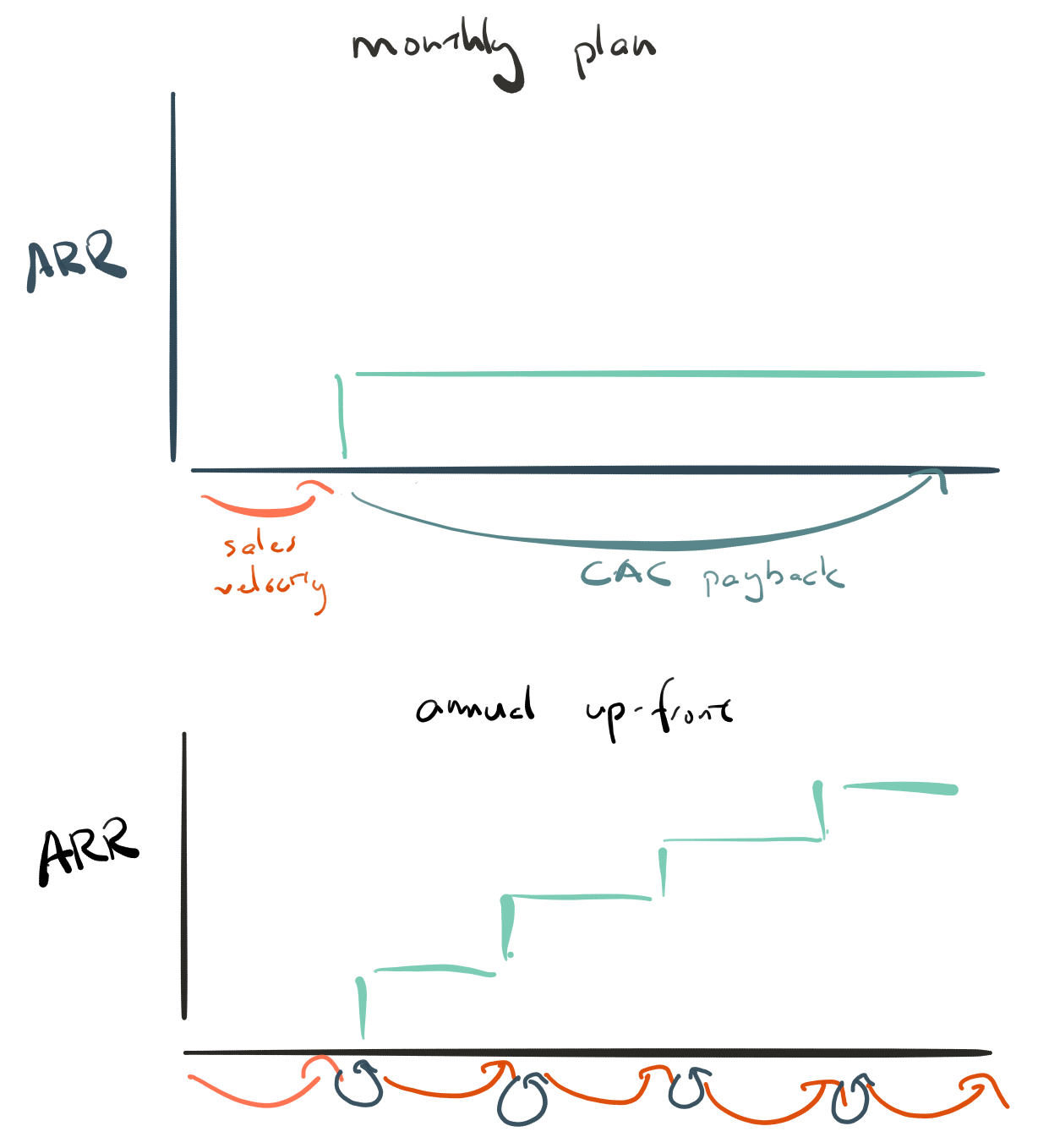

Ever wonder why companies offer such deep annual discounts? Changing sales velocity is a much harder problem than offering discounts to get someone to pay you upfront. Its effect on cash flow and eventually revenue growth are near-exponential.

In the hypothetical Sentry, I’ve spent $600 and one month to acquire one customer. For paid acquisition, the timer starts when money leaves your bank account and stops when it comes back. For our purpose, we’ll assume the timer starts when the click happens and the initial advertising money is spent1. If the customer pays monthly, I can only invest $50 back into the business the next month, buying “1/12th” of a customer. The next month I can buy another 1/12 + 1/144 of a customer, and so on. By end of year, I have 2.4 customers.

If the customer pays annually, it means I can immediately sink the new revenue back into the top of the funnel to acquire another customer, and I can do this every month. By end of year, I have 12 customers and therefore 5x the revenue!

The same $600 investment now is paying very different dividends. The monthly case is now paying me $1200/year. The annual case is paying me $7200! If I discount my annual price by 1/6 (as many SaaS companies are fond of doing), I end up with 5.3 customers. These annual customers are paying a discounted price, so the equivalent of 4.4 monthly customers in revenue, but still over 80% more revenue.

Let’s play with sales velocity now. If your sales velocity is 2 months instead of 1 month and your annual discount is 25% (3 months free), annual pricing produces 2.5 customers (in equivalent monthly revenue) whereas monthly pricing produces 2.2. Despite the discounting and the considerably reduced compounding you get when your sales velocity decreases, the power of upfront cash still wins. Therefore, once the business understands its funnel and can reliable re-invest its money into marketing, one of the strongest levers into growth is reducing CAC payback period. This also means that, once the funnel and cash flow are well understood, you can potentially start paying more than breakeven for top of the funnel, as acquiring one customer might actually mean acquiring three.

This is also why most SaaS businesses strongly segregate their forever-free and potential paying customers. Opting potential paying customers into a trial (and thus buying decision) increases sales velocity and lets marketing increase their CPC’s. Free users are immensely valuable for marketing and eventual-conversions, it’s probably better to save your marketing dollars2.

That’s it! From there, it’s literally just the work of 1. finding better ways to spend money at the top and 2. improving conversions and velocity 3. repeat. And if this all hasn’t put you to sleep, have I got a job for you.

Footnotes

-

With online ads, you usually pay for the clicks with a credit card at the end of the month. If you time it correctly, you can even pay for the credit card at the end of the next month. This means if your customer clicks through and immediately pays annual up front, it’s possible you could have negative CAC, which has…gravity defying properties. This rarely happens, but when it does, you get businesses like Amazon. There are also funny tax implications when a business can run at near-zero profits. ↩

-

Event marketing is actually the worst for cash flow. You pay months ahead of time, further extending your CAC payback period. However, in terms of generating broad awareness for ad-block savvy audiences like developers, there are few better channels. Content marketing is also tricky, as it requires massive up front cost and generates slow but continuous source of leads. ↩